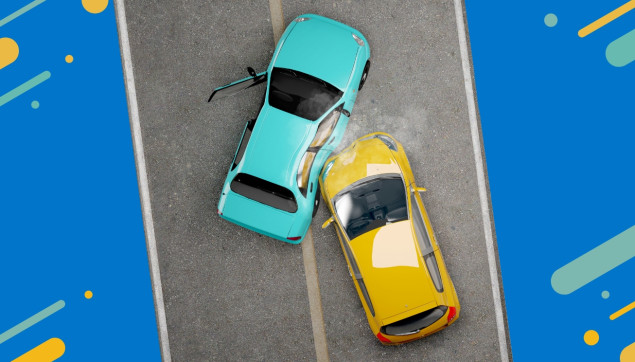

Car accident? Don’t miss these important next steps

Published on 20th March, 2023 at 11:52 am

From minor scrapes and dings to more serious collisions, it helps to know what you should do if you get into a car accident to ensure a smooth insurance claim process. Here’s your guide.

Reading time: 3 minutes

In this article you’ll learn:

- The immediate steps to take when you’re in a vehicle collision.

- What you should avoid doing to ensure a smoother insurance claim process.

- How the Sanlam Reality vehicle value calculator can help you insure your vehicle for the right value.

If your vehicle is causing a dangerous obstruction, move it to avoid further collisions and then follow these steps:

What photos should you take?

If you are uninjured and the vehicles involved don’t need to be moved immediately, take photos or videos at the initial scene. Attorney Garth Armstrong of Venters Incorporated, which operates in the field of personal injury law with specialisation in Road Accident Fund (RAF) claims, notes that people often focus on taking close-up photos of the damage to vehicles; however, a panoramic or wider angle photo showing all the vehicles involved in the collision and the position of those vehicles in relation to one another (preferably taken from a slightly higher vantage point) can provide important evidence.

You’ll also need to take photos of the following:

- the damage sustained during the accident,

- the registration plate,

- licence disc,

- odometer reading,

- photos of the vehicle make and model,

- the vehicles in relation to each other (if there’s a third-party vehicle).

What insurance details should you gather at the scene?

Important details to gather at the scene include:

- the ID number and contact details of the other driver(s),

- the name and contact details of the other driver(s)’s insurer,

- the name of the policyholder,

- witness details (if any),

- if possible, recordings from the accident scene between you and the third party.

How soon should you contact your insurance company?

Santam is part of the Sanlam Group, and is South Africa’s leading general insurer, covering claims for vehicle collisions, among other events. Santam’s public liability (PL) policy contract states that “you must notify us immediately after any event which may result in a claim”.

However, Thabo Manamela, head of Quality and Knowledge Management at Santam, says, “If the insured is unable to do this due to an injury (for instance, being in a coma), Santam will not summarily reject a claim, but will take the circumstances into consideration. Each claim will be viewed on its own merit, and if Santam was prejudiced by the delay in notification, the merits of the delay will be investigated and be considered with fairness.”

Your car depreciates in value every year, which means you could be over-insured. Use the Sanlam Reality vehicle value calculator to ensure your vehicle is insured for its retail value.

Things you should avoid saying/doing

“In view of the public liability (PL) policy contract, the insured or beneficiary under the insured’s policy contract should not admit any liability in the event of an accident,” says Manamela. “Santam should be afforded an opportunity to investigate and validate the claim under favourable circumstances. The policy states, “You may not, without our written consent, admit liability, offer, promise or pay in respect of any event that may result in a claim.”

If you’re looking to keep your overall car expenses low, use these tips.

When do you need an attorney and how soon should you contact one?

If you have incurred a personal injury, you’ll need an attorney that specialises in RAF claims to help you. Those who try to claim directly from the RAF or who go to a general attorney are likely to receive less, or even no remuneration, as RAF claims fall into a difficult and specialised field of law.

“It’s imperative that you contact a personal injury lawyer as soon as you are discharged from the medical facility where you are receiving treatment,” says Armstrong. “It can take up to 18 months to gather the evidence and build the case, and if you don’t issue a summons within the prescribed period, the claim will die, and there would be no recourse.”

If you’re insuring your car, use Sanlam Reality’s vehicle value calculator to avoid over- or under-insuring your vehicle. Plus, get the best rate for insurance with this handy guide.

Want to learn more?

We send out regular emails packed with useful advice, ideas and tips on everything from saving and investing to budgeting and tax. If you're a Sanlam Reality member and not receiving these emails, update your contact details now.

Update Now