Three lifestyle changes to boost your retirement savings

Last updated on 5th December, 2018 at 02:44 pm

Take control of what you spend your money on to ensure you have enough savings left at the end of the month to put towards your retirement.

Retiring in style is not so easy because inflation is your enemy. Every year, things like food, medical cover and transport costs increase. Fluctuations in the rand, petrol price increases, political instability, increasing costs and rate hikes are all contributing factors to the cost of living, but often you have very little control over them.

However, you do have control over what you spend your money on. Here are three lifestyle changes you can make to ensure you have more money every month to add to your pension pot…

Downscale your home

Owning a big family home is something that many of us dream about and actively pursue. However, a large home can be expensive to maintain. Just think about it… There’s a pool to keep crystal clear with chemicals, not to mention water costs; gardens need to be kept tidy; roofs need to be cleared of debris and fixed; and walls and gates need to be painted on a regular basis. These costs can all add up and potentially result in you putting away less towards your retirement fund.

So think carefully about what you need and what you can afford. Moving to a smaller home or even a townhouse or apartment can free up extra income from the sale (if you’re downscaling), as well as extra money on an ongoing basis from having less maintenance costs and expenses.

Use alternative modes of transport

Owning a car can be really costly as you need to pay for expenses like parking, petrol, cleaning, licensing and insurance. Consider using public transport or a ride service like Uber, particularly if you drive short distances every day.

Have you ever worked out what you could save by not buying and owning a car, and instead trying these alternate transport options? One study conducted by MyTreasury.co.za calculates the savings you could make at around R111 000 annually. Imagine this money going into your retirement fund or other important savings accounts… It could be a real game-changer.

If you need to own a car, make sure you service it regularly. If you don’t, small mechanical faults could end up becoming bigger ones, which will cost you more to fix. Also remember, you don’t have to keep up with the Joneses and upgrade your vehicle every year.

Cut back on expenses

A real reality check can be assessing your monthly spending habits. Look at absolutely everything you spend on in any given month, from the daily coffee fix to late-night takeaways, cellphone airtime, clothes accounts and more. You’ll probably find you’re spending too much on luxury items and entertainment.

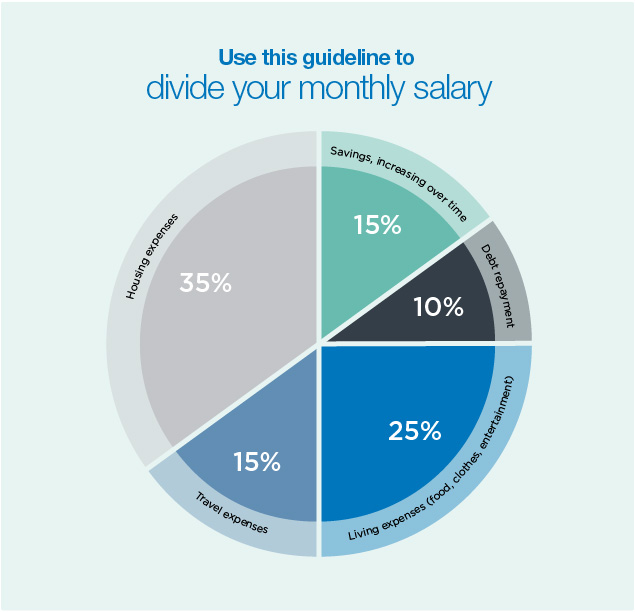

You can use this rule of thumb to calculate what percentage of your monthly salary you should be spending on different expenses:

However, it is also important to work out just how much you need personally for your retirement. This might feel overwhelming – so rather get an accredited financial planner to do this for you. Once you know how much you need to save monthly for retirement, you can cut back on expenses according to your needs.

Remember that each month you put off saving in favour of spending, you’ll have to save even more in later years if you want to retire comfortably.

Want to learn more?

We send out regular emails packed with useful advice, ideas and tips on everything from saving and investing to budgeting and tax. If you're a Sanlam Reality member and not receiving these emails, update your contact details now.

Update Now